Understanding currency conversions is crucial for anyone engaged in international business, planning overseas investments, or considering relocation to another country. For those dealing with South Korean won and US dollars, knowing how to convert 45 million won to USD provides valuable context for financial planning and decision-making. This comprehensive guide explores the intricacies of currency exchange, practical applications, and strategic considerations that can help you make informed financial choices.

Understanding the Current Exchange Rate

The conversion of 45 million won to USD depends on the prevailing exchange rate between the South Korean won (KRW) and the United States dollar (USD). As of recent data, the exchange rate typically hovers around 1,300 to 1,400 won per dollar, though this fluctuates based on various economic factors. At an exchange rate of approximately 1,350 KRW per USD, 45 million won converts to roughly $33,300 USD.

45 Million Won to USD represents a significant amount of money in both currencies, making it essential to understand not just the conversion itself, but also the broader implications for your financial planning. Whether you’re evaluating a business opportunity in Seoul, considering property purchases, or planning retirement abroad, grasping the real value of this conversion is fundamental.

Factors That Influence Currency Exchange Rates

Several key factors affect the exchange rate between won and dollars, which in turn impacts what 45 million won to USD actually means at any given moment. Understanding these elements helps you anticipate potential changes and plan accordingly.

Economic Performance and Growth

45 Million Won to USD relative economic strength of South Korea and the United States plays a significant role in currency valuation. When South Korea’s economy shows robust growth, exports increase, or major corporations like Samsung and Hyundai perform well, the won typically strengthens against the dollar. Conversely, strong US economic indicators can strengthen the dollar, meaning you’d receive fewer dollars when converting won.

Interest Rate Differentials

45 Million Won to USD banks in both countries set interest rates that influence currency values. The Bank of Korea and the US Federal Reserve make decisions that can cause significant shifts in exchange rates. Higher interest rates in one country typically attract foreign investment, increasing demand for that currency and strengthening its value relative to others.

Political Stability and Trade Relations

Geopolitical events, trade agreements, and diplomatic relations between nations affect currency markets. The US-Korea Free Trade Agreement, regional tensions, or changes in trade policies can all impact the value proposition when converting 45 million won to USD.

Market Sentiment and Speculation

45 Million Won to USD traders and investors worldwide make decisions based on expectations about future economic conditions. This collective sentiment can drive exchange rate movements even before actual economic changes occur.

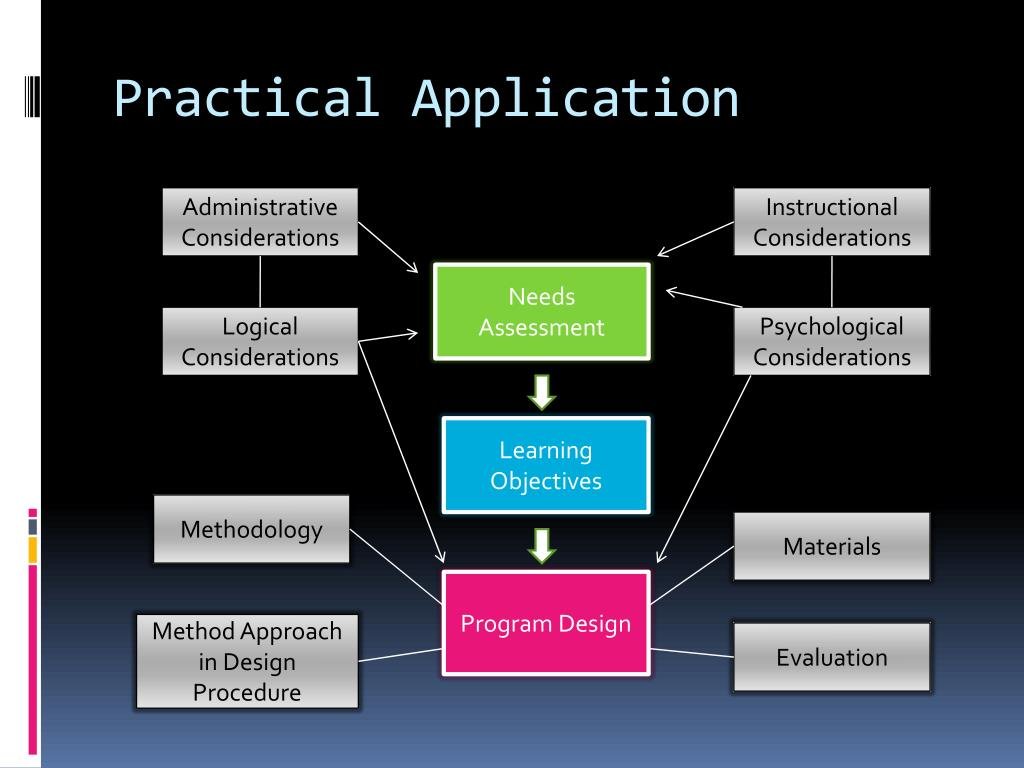

Practical Applications: When You Might Convert 45 Million Won

Understanding when and why someone might need to convert 45 million won to USD helps contextualize the importance of this particular conversion amount.

Real Estate Transactions

In South Korea’s major cities, 45 million won might represent a down payment on a modest apartment or a partial payment toward property. For investors considering Korean real estate, understanding this conversion helps evaluate whether opportunities offer good value compared to US market alternatives. Similarly, Korean nationals purchasing property in the United States need to understand how their savings translate.

Business Investments and Startup Capital

45 Million Won to USD looking to establish businesses across borders frequently deal with conversions in this range. Whether you’re a Korean entrepreneur expanding to American markets or a US investor exploring Korean opportunities, knowing the real value of 45 million won to USD helps in budgeting, financial projections, and partnership negotiations.

Education and Living Expenses

For students planning to study abroad, this amount could cover a significant portion of tuition and living expenses. Korean students attending American universities or American students participating in extended programs in Korea need to budget effectively, and understanding currency conversion helps prevent financial surprises.

Retirement and Expatriate Living

Retirees and expatriates often transfer larger sums between countries. Converting 45 million won to USD might be part of retirement fund management, especially for those splitting time between countries or permanently relocating.

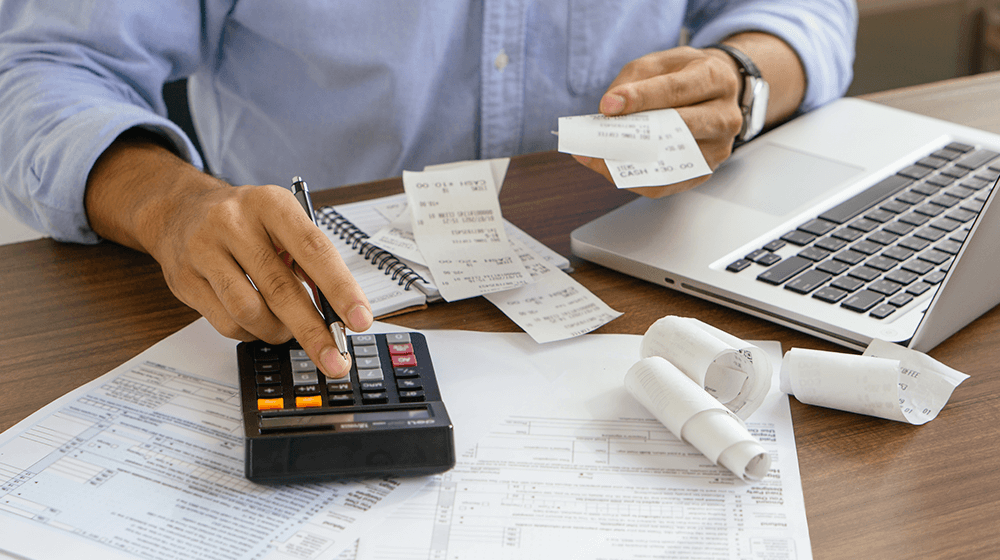

Strategies for Maximizing Your Currency Exchange

When dealing with substantial amounts like 45 million won, employing smart strategies can save thousands of dollars in exchange fees and unfavorable rates.

Timing Your Exchange

Currency markets fluctuate daily. Monitoring trends over weeks or months can help you identify favorable exchange periods. While predicting exact movements is impossible, understanding general trends in both economies provides strategic advantage. Some financial planners recommend dollar-cost averaging for large conversions, splitting the total into smaller exchanges over time to mitigate risk.

Choosing the Right Exchange Method

Not all currency exchange methods are created equal. Banks typically charge higher fees and offer less favorable rates than specialized currency exchange services. Online platforms like Wise, OFX, or dedicated forex brokers often provide rates much closer to the mid-market rate, potentially saving you hundreds or thousands of dollars when converting 45 million won to USD.

Understanding Fee Structures

Exchange services make money through a combination of marked-up exchange rates and explicit fees. A seemingly small difference of 10-20 won per dollar adds up significantly when converting 45 million won. Always calculate the total cost, including both rate markup and transaction fees, before choosing a service.

Consider Forward Contracts

For planned future conversions, forward contracts lock in today’s exchange rate for a transaction occurring weeks or months later. This protects you from adverse rate movements, providing certainty for financial planning even if you sacrifice potential gains from favorable movements.

Also Read this; Business Money Market Account: Smart Ways to Grow and Protect Funds

Tax Implications and Legal Considerations

Converting 45 million won to USD isn’t just about mathematics; it also involves legal and tax considerations that vary depending on your specific situation.

Reporting Requirements

Both the United States and South Korea have reporting requirements for international money transfers above certain thresholds. In the US, transfers exceeding $10,000 must be reported to the IRS. Failure to comply with reporting requirements can result in significant penalties making it essential to understand your obligations.

Capital Gains and Income Tax

Depending on the source of your 45 million won and your tax residency status, the conversion and transfer might have tax implications. Money derived from investment gains, business income, or property sales may be subject to taxation in one or both countries. Consulting with a tax professional experienced in international taxation ensures compliance and potentially identifies legal strategies to minimize tax burden.

Currency Exchange Controls

While both the United States and South Korea have relatively open currency policies compared to some nations, understanding any limitations or documentation requirements prevents delays in your transaction.

Using Technology for Better Exchange Decisions

Modern technology provides tools that make converting 45 million won to USD more transparent and cost-effective than ever before.

Real-Time Exchange Rate Apps

Numerous smartphone applications provide real-time exchange rate information, historical data, and rate alerts. Setting notifications for when rates reach your target threshold allows you to act quickly when favorable conditions emerge.

Comparison Platforms

Websites that compare exchange services side-by-side help identify the most cost-effective option for your specific transaction. These platforms often reveal significant differences in total costs between providers.

Digital Banking Solutions

International digital banks and fintech companies offer multi-currency accounts that allow you to hold, exchange, and transfer funds with greater flexibility and often lower costs than traditional banks.

Long-Term Financial Planning Considerations

When 45 million won to USD conversion is part of broader financial strategy, several long-term considerations come into play.

Diversification Benefits

Holding assets in multiple currencies can provide portfolio diversification. Exchange rate movements sometimes offset losses in other investment categories, reducing overall portfolio volatility.

Inflation Considerations

Different countries experience different inflation rates. Over time, this affects the real purchasing power of money held in each currency. When planning long-term, consider not just exchange rates but also the expected inflation differential between countries.

Future Exchange Rate Projections

While predicting exchange rates with certainty is impossible, understanding long-term economic trends helps inform decisions. Consider factors like demographic trends, productivity growth, government debt levels, and trade balances when thinking about future currency values.

Common Mistakes to Avoid

Learning from common errors helps you navigate currency exchange more successfully.

Exchanging at Airports or Hotels

These locations typically offer the worst exchange rates, sometimes 10-15% worse than market rates. For amounts like 45 million won, this could mean losing thousands of dollars unnecessarily.

Ignoring Hidden Fees

Services advertising “no fees” often build costs into unfavorable exchange rates. Always calculate the total amount you’ll receive, not just the stated fees.

Making Emotional Decisions

Currency markets can be volatile, causing anxiety about timing. Having a clear strategy and sticking to it prevents emotionally-driven decisions that often prove costly.

Neglecting to Compare Options

The first option isn’t always the best. Taking time to compare multiple exchange services for your 45 million won conversion can yield significantly better results.

Conclusion

Converting 45 million won to USD represents a significant financial transaction that deserves careful consideration and strategic planning. By understanding the factors that influence exchange rates, employing cost-effective conversion methods, considering tax and legal implications, and leveraging modern technology, you can maximize the value received from your currency exchange.

Whether you’re making this conversion for business, education, real estate, or personal reasons, the insights provided here equip you with the knowledge needed for better financial planning. Remember that currency exchange is just one component of comprehensive international financial management. Consulting with financial advisors, tax professionals, and legal experts ensures your currency conversion aligns with your broader financial goals while maintaining full compliance with all applicable regulations.

In an increasingly interconnected global economy, understanding currency conversion isn’t just useful—it’s essential for anyone engaged in international financial activities. By approaching your currency exchange with knowledge, strategy, and attention to detail, you transform what might seem like a simple transaction into an opportunity for optimized financial outcomes.

1 thought on “45 Million Won to USD: Essential Insights for Better Financial Planning”